If there is one major sector that will suffer like few others in the major decline it is going to be the banks.

Stories about banks recommending their employees get private carry permits, and Fed Chairman nearly missing a renomination are going to be common fodder soon enough. In fact, we estimate that banks are going to be even more hated this time around than they ever were during the Great Depression (Ever wonder why your grandparents always told you they hated bankers? You'll have ample opportunity to replace that wonder with a fresh dose of loathing that's all yours)

Furthermore, the financial sector topped out before the broad markets, just as they did in 2007. We are anticipating a crushing, near fatal blow to the financial sector in terms of stock prices over the coming year. As such, you have ample opportunity to get in, and you pretty much have the pick of the litter!

I wouldn't recommend shorting some of the big names like Citigroup or BAC - while they may yet go to the alternate (bankruptcy) exchange, the downside potential is not as great in dollar terms as some of those bank whose stocks have staged a momentous comeback.

We've been short the financials via LEAPS since September - and we unfortunately can't post our most profitable positions on here because that is going to be a subscriber only feature. Needless to say they are performing well and we expect some of our LEAPS to make upwards of 500% - 1000% as this decline continues.

But there are two big-boys who look ripe for the short - and the nice is that these are stocks you can verily short anytime in the next couple of days and they should produce an extraordinary profit in the coming months.

My favorites, and soon-to-be-most-hated-of-them-all, are of course Goldman Sachs and JPMorgan Chase. Coming up so close to their 52-week highs (relative to their brethren of the money), the mood toward them is far more elevated than to firms like AIG and Citigroup, who topped out even before the broad financial sector.

So we are formally recommending you short these two into the dirt - and virtually any other financial institution that seems to follow the Financial Index fairly closely.

Goldman has just broken through a head-and-shoulders neckline, and will probably make a break-up attempt to the $160.00 mark where the neckline is. I would recommend opening up a short position now, and doubling or tripling up on it at this point because if it does make it that high, there will be a serious roof there. Officially, we are short Goldman.... Now - at $153.35.

JPMorgan Chase should be experiencing a major leg down within the next 1-2 weeks (possibly 1-2 days though. It's at a pretty precarious point.), and as such we highly, and cheerfully, recommend shorting the beloved Mr. Dimon's bank along with his "vampire squid" counter part GS.

Officially, we are short JPM at 39.65.

Hold on to your seats.

Another though as well, which I'll do some more analysis on shortly, is a little (or not so little anymore) Chinese company which looks to be a ripe short.

This one is actually a top pick from one of the more popular economists of the Austrian School, has had an explosive runup, and seems to have made a topping formation. Any guesses?

We'll follow up on this one early next week.

Best of luck!

Derek.

Friday, January 29, 2010

Thursday, January 28, 2010

An Update on our Latest Short Recommendation

For those of you who haven't been keeping track, we've had some interesting developments in the psychology towards the PIGS since early January. Much of this has to do with the imminent and long-term shift in psychology towards the Euro, which will grow more negative in the coming years.

As to that, let's be serious - the Euro is the most centrally planned currency in the world (One central bank for 10 economies? A central bank for ONE economy does enough destruction on a long enough time scale - for 10 we should see some interesting results). It is our opinion that (with about 5000 years of history on our side), since central planning of money instead of letting the market determine its makeup and amount leads to long term malinvestment on a massive scale, and is essentially the cause of depressions (see current one for reference), attempting this crazy experiment for TEN countries is.... some non-existent word that means "a thousand time crazy".

Anyway, the point of the matter is that the broad and severe negative shift towards the world's "darling" currency, the EURO, has gotten underway. People will point figures at sovereign debt downgrades and potential defaults and bailouts etc, but the fact of the matter is the underlying psychology is responsible for these things, and these "events" are the results of major shifts in perception.

And so I had no qualms about shorting this lovely Spanish bank back on the 8th of January (we posted the recommendation on the 7th and executed the trade on the 8th), and as such, we have seen some "as expected" results.

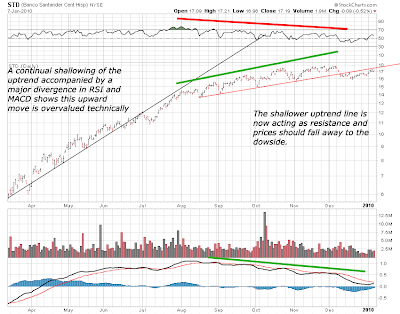

Here's the original chart of the stock:

As to that, let's be serious - the Euro is the most centrally planned currency in the world (One central bank for 10 economies? A central bank for ONE economy does enough destruction on a long enough time scale - for 10 we should see some interesting results). It is our opinion that (with about 5000 years of history on our side), since central planning of money instead of letting the market determine its makeup and amount leads to long term malinvestment on a massive scale, and is essentially the cause of depressions (see current one for reference), attempting this crazy experiment for TEN countries is.... some non-existent word that means "a thousand time crazy".

Anyway, the point of the matter is that the broad and severe negative shift towards the world's "darling" currency, the EURO, has gotten underway. People will point figures at sovereign debt downgrades and potential defaults and bailouts etc, but the fact of the matter is the underlying psychology is responsible for these things, and these "events" are the results of major shifts in perception.

And so I had no qualms about shorting this lovely Spanish bank back on the 8th of January (we posted the recommendation on the 7th and executed the trade on the 8th), and as such, we have seen some "as expected" results.

Here's the original chart of the stock:

And here is the update chart.

Despite the fact that I had some fairly severely worded emails questioning my analysis of this bank "when the US financial system is collapsing", you can see that this trade is certainly running in our favor. Not to say there certainly aren't some excellent shorting opportunities in US financials and commercial real estate owners, but maybe we just wanted a to do a jota.

I am placing a stop at $15.40 just in case the most recent and severe gap does fill and the corrective reversal comes early - there is a fairly low probability of this, however that seems to be the tightest stop I can allow considering the size of some of the intraday moves.

As such the trade is 17.7% in the money right now, gross, and should continue to yield higher. Pay attention to the last major unfilled gap from July 2008, which should offer some support and a major corrective area - I'm anticipating closing out the position around there and letting the correction run up before shorting again - the end target is below March low, certainly under $5.00 per share, so there is some excellent profit potential.

One final note. One of the advantages of short-selling stocks that are listed on the US exchanges is that they are not only going down in value, but the USD is going up in value. For example, if you are a long-term gold or silver buyer, consider the following two options (This is sort of our mid-term plan of action):

If you short the S&P Minis or Dow Minis and gain 50%, say with $10,000.00 - you will have $15,000.00 at the end of the trade.

If gold drops down to $650 or so, which is our current target area, from here ($1100), the price is down 41%. If silver drops down below $9.00, which is our target range, from here ($16.50), that is down 47%.

I'll lay out two scenarios for you:

In scenario 1, you buy $5,000 worth of gold and $5,000 worth of silver. This grabs you about 4.5 ounces of gold and about 320 ounces of silver. That's what you get. Whether the price of gold and silver does go down to $650 and $9.00, respectively, or we hit the stratosphere like all the gold bugs are saying is the next step, you have 4.5 ounces of gold and 320 ounces of silver. If that is a risk you are willing to take as a buyer then that is your choice.

In scenario 2, let's say the market plays out like we anticipate - actually not quite because we are saying a much higher gain than 50% on a short-sell from the market peak, but we'll use 50% anyway.

So, you forgo buying gold and silver in favor of taking you $10,000 and shorting the broad market with it.

You end up with $15,000.00 net when you close the transaction. Let's say for the sake of argument that you don't get bottom on the metals and you pick up gold at $700 / oz, and silver at $10.00 / oz.

$7500 to gold, and $7500 to silver.

This nets you 10.5 ounces of gold and 750 ounces of silver.

Essentially if that is your game plan you are actually ending up with 233% more gold and 234% more silver than if you had just bought. Again, the risk analysis for your own money is all yours to have in the end, however given that nobody can really provide any real price objectives for gold except to use loose historical facts and such, and that we were 5 days from nailing the top in gold....

That's of course if that is your game plan. If you are like us you are going to be looking at some of the best companies in the world yielding over 10% - 15% by the time the market bottoms and that sounds pretty appealing from where I'm sitting....

The Dow is thus far still following that expanding triangle I drew at the end of the day yesterday and did indeed bounce off of the 50 EMA to move lower. It might make another run at the upper area of the triangle, however the probability is for one more solid new low before a larger corrective pattern forms.

Keep your heads out there.

Derek.

Wednesday, January 27, 2010

Every Market for Itself! (Or All for One)

It appears that the short respite from this bear market is coming to a quick close. As we have forecast for some time, the everything-but-the-USD bear market is underway and as such our goal is to notify you of topping formations, as the bottom is a little further into the future than our crystal ball is willing to tell.

Technically, the Dow looks ready for a solid breakdown to new lows, as does gold. Silver seems to have already begun its next down-leg, having lost 11% in the last 4 trading days as of the time of this writing. Gold has begun the larger portion of its bear market decline, which started on Jan 11. We should see prices somewhere in the mid to low $900's before this portion is completed and we can expect a sizable correction.

For reference, here is a chart with technical labeling.

or

What we called for as the highest probability move did not occur today (that's the funny thing about probability, right?), however there are a few things I noticed when I pulled back the chart to a 30 minute bar and put my favorite 50 and 120 day moving averages to action.

One thing that does work in favor of a higher move is the fact that the moving averages are extremely spread apart, which often times will lead to either a sharp correction or a long sideways period - generally when your moving averages are closer together and moving more flat, there is a decent sized breakout brewing. Just something to keep in mind.

Here's the end-of-day chart:

Derek.

Technically, the Dow looks ready for a solid breakdown to new lows, as does gold. Silver seems to have already begun its next down-leg, having lost 11% in the last 4 trading days as of the time of this writing. Gold has begun the larger portion of its bear market decline, which started on Jan 11. We should see prices somewhere in the mid to low $900's before this portion is completed and we can expect a sizable correction.

For reference, here is a chart with technical labeling.

For our thoughts on the Dow, see here:

How so many people can argue that "fundamentals" drive the price of any asset at this point in the game is beyond me - or, worse yet, how some can say "stocks are not being fundamentally driven right now and are riding on hope" but "the fundamentals on gold are excellent and the price is going so high it will blow your mind!".

You can't have your cake and eat it too. When I see headlines such as this:

Folks who argue that "gold goes up during downturns" and then in the next sentence say "the economic recovery is what is making gold prices higher".

and what about seeing things like the following:

vs.

Are you feeling any more enlightened? I'm certainly not. The traditional media's means of attaching an external event to a price movement that is purely psychological in nature is laughable at best - and often produces these comical results.

Here at Investophoria we use technical analysis because prices are unbiased - they are simply numbers that reflect past actions. Certainly, the technician can be biased one way or the other, and we attempt to stay rigidly within the "cool, collected, and detached" category of forecaster. As such, we can say with conviction that this bear has just taken the first step out of his cave after a long and deep nearly-comatose slumber.

What woke him up?

A bunch of happily cheering market participants who have come to yet again believe that no matter where they put their money, it will always go up "in the long term".

Best of luck all!

Derek.

End of Day Update:

What we called for as the highest probability move did not occur today (that's the funny thing about probability, right?), however there are a few things I noticed when I pulled back the chart to a 30 minute bar and put my favorite 50 and 120 day moving averages to action.

One thing that does work in favor of a higher move is the fact that the moving averages are extremely spread apart, which often times will lead to either a sharp correction or a long sideways period - generally when your moving averages are closer together and moving more flat, there is a decent sized breakout brewing. Just something to keep in mind.

Here's the end-of-day chart:

Best of Luck, and keep your heads out there!

Derek.

Monday, January 25, 2010

The Dow is Playing By the Book

If you are a futures or mini trader and have been following our analysis of the Dow over the past several months you should be a pretty happy camper.

As we mentioned Friday, the highest probability scenario we foresaw was some sideways consolidation for the day to move across that channel and give another late-entry short opportunity. If the chart does play out as we foresee, we should experience one final down-move to finish off the initial formation of this downtrend.

Once that move is complete at least several days of recovery will be in order, that should probably take the down up to about a 1/3 - 50% retracement of this leg-down.

One thing of note is that the channel we have drawn seems to be of some importance in psychological measurement, as the Dow gapped up through the primary lower channel line and did not come down to fill the gap until after the channel had descended below the precious day's close. This should offer us a good guide as to the next and potentially final drop in price that will complete the first move of this broader bear market decline.

As we mentioned Friday, the highest probability scenario we foresaw was some sideways consolidation for the day to move across that channel and give another late-entry short opportunity. If the chart does play out as we foresee, we should experience one final down-move to finish off the initial formation of this downtrend.

Once that move is complete at least several days of recovery will be in order, that should probably take the down up to about a 1/3 - 50% retracement of this leg-down.

One thing of note is that the channel we have drawn seems to be of some importance in psychological measurement, as the Dow gapped up through the primary lower channel line and did not come down to fill the gap until after the channel had descended below the precious day's close. This should offer us a good guide as to the next and potentially final drop in price that will complete the first move of this broader bear market decline.

Enjoy your trading day everyone!

Derek.

Subscribe to:

Comments (Atom)