As to that, let's be serious - the Euro is the most centrally planned currency in the world (One central bank for 10 economies? A central bank for ONE economy does enough destruction on a long enough time scale - for 10 we should see some interesting results). It is our opinion that (with about 5000 years of history on our side), since central planning of money instead of letting the market determine its makeup and amount leads to long term malinvestment on a massive scale, and is essentially the cause of depressions (see current one for reference), attempting this crazy experiment for TEN countries is.... some non-existent word that means "a thousand time crazy".

Anyway, the point of the matter is that the broad and severe negative shift towards the world's "darling" currency, the EURO, has gotten underway. People will point figures at sovereign debt downgrades and potential defaults and bailouts etc, but the fact of the matter is the underlying psychology is responsible for these things, and these "events" are the results of major shifts in perception.

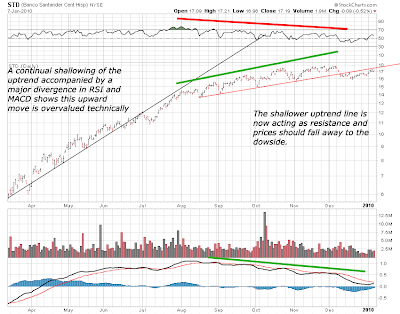

And so I had no qualms about shorting this lovely Spanish bank back on the 8th of January (we posted the recommendation on the 7th and executed the trade on the 8th), and as such, we have seen some "as expected" results.

Here's the original chart of the stock:

And here is the update chart.

Despite the fact that I had some fairly severely worded emails questioning my analysis of this bank "when the US financial system is collapsing", you can see that this trade is certainly running in our favor. Not to say there certainly aren't some excellent shorting opportunities in US financials and commercial real estate owners, but maybe we just wanted a to do a jota.

I am placing a stop at $15.40 just in case the most recent and severe gap does fill and the corrective reversal comes early - there is a fairly low probability of this, however that seems to be the tightest stop I can allow considering the size of some of the intraday moves.

As such the trade is 17.7% in the money right now, gross, and should continue to yield higher. Pay attention to the last major unfilled gap from July 2008, which should offer some support and a major corrective area - I'm anticipating closing out the position around there and letting the correction run up before shorting again - the end target is below March low, certainly under $5.00 per share, so there is some excellent profit potential.

One final note. One of the advantages of short-selling stocks that are listed on the US exchanges is that they are not only going down in value, but the USD is going up in value. For example, if you are a long-term gold or silver buyer, consider the following two options (This is sort of our mid-term plan of action):

If you short the S&P Minis or Dow Minis and gain 50%, say with $10,000.00 - you will have $15,000.00 at the end of the trade.

If gold drops down to $650 or so, which is our current target area, from here ($1100), the price is down 41%. If silver drops down below $9.00, which is our target range, from here ($16.50), that is down 47%.

I'll lay out two scenarios for you:

In scenario 1, you buy $5,000 worth of gold and $5,000 worth of silver. This grabs you about 4.5 ounces of gold and about 320 ounces of silver. That's what you get. Whether the price of gold and silver does go down to $650 and $9.00, respectively, or we hit the stratosphere like all the gold bugs are saying is the next step, you have 4.5 ounces of gold and 320 ounces of silver. If that is a risk you are willing to take as a buyer then that is your choice.

In scenario 2, let's say the market plays out like we anticipate - actually not quite because we are saying a much higher gain than 50% on a short-sell from the market peak, but we'll use 50% anyway.

So, you forgo buying gold and silver in favor of taking you $10,000 and shorting the broad market with it.

You end up with $15,000.00 net when you close the transaction. Let's say for the sake of argument that you don't get bottom on the metals and you pick up gold at $700 / oz, and silver at $10.00 / oz.

$7500 to gold, and $7500 to silver.

This nets you 10.5 ounces of gold and 750 ounces of silver.

Essentially if that is your game plan you are actually ending up with 233% more gold and 234% more silver than if you had just bought. Again, the risk analysis for your own money is all yours to have in the end, however given that nobody can really provide any real price objectives for gold except to use loose historical facts and such, and that we were 5 days from nailing the top in gold....

That's of course if that is your game plan. If you are like us you are going to be looking at some of the best companies in the world yielding over 10% - 15% by the time the market bottoms and that sounds pretty appealing from where I'm sitting....

The Dow is thus far still following that expanding triangle I drew at the end of the day yesterday and did indeed bounce off of the 50 EMA to move lower. It might make another run at the upper area of the triangle, however the probability is for one more solid new low before a larger corrective pattern forms.

Keep your heads out there.

Derek.

Hi Derek,

ReplyDeleteI believe one aspect you forgot to mention in your scenario where you shorted the market instead of buying the AU/Ag bullion with $10,000. was that after your 50 percent market profit you have to pay taxes on said profit. Buying and selling bullion there are no taxes to be paid. I have spoken with one top national bullion dealer and asked about this and I was told that they don't report private transactions.

Very true - I know in Canada they don't report my buying or selling, but I'm not sure in the US.

ReplyDeleteCapital gains tax is 50% of your normal rate of income tax which would probably work out to about 18% or so. Essentially you would have $14,000 with which you could buy bullion at a cheaper price after tax.

Thanks for the input.

Derek.

Hi Derek, I like your site and the good info that it provides. One question though, if you feel that Gold and silver are heading considerably lower do you also feel that the Canadian dollar will follow? It seems to follow the commodities step for step. Thanks.

ReplyDeleteHi Derek,

ReplyDeleteYour site is very refreshing as there has been too much bullish noise going around, but like most contrarian investors you seem to be ridiculed unfortunately. Personally I am happy I found your blog as I have made money off your Spanish short call, and I hope you continue to share your insight with us.

Orion

Anonymous - as it stands right now the Canadian dollar is set to lose serious ground vs the US, going to at least the low set in March '08 at around 77.5 cents US. We advised our clients to move their cash savings into USDs almost two months ago at $1.035 and thus far that little move alone has yielded them a roughly 3% gain in CASH terms. We expect this gain to be around 25% - 30% or higher, and will be focusing on some CAD/USD action as the trend continues.

ReplyDeleteAs it stands now our view is the everything-but-the-USD decline in North America, and everything priced in USD's.

Fatboy,

Thanks for the compliment - glad to see you've been putting some of our free advice to work - if you like these tidbits you'll be very excited about our upcoming new site and subscription services, where we'll be giving the best high-probability trades and income assets to subscribers.

As for continuing, I certainly plan on it - although I'm going to put a lid on the number of subscribers I get because I don't want to build too much recognition - for some reason there seems to be an age-old equation about fame and failure in this type of business - I'll skip right on over those things and keep a nice core and low-key service to make sure my clients are getting the best.

Have a good night.

Derek.

So despite taxes scenario number 2 as you say still seems best. Reviewing history we see that most bull markets last between 16-18 years and are followed by a similar number of bear years. As the last secular bull market was from 1982 to 2000 where one could have purchased the DOW for one ounce of gold, it follows that we have another 8 years or so before we see that 1:1 ratio which is a classic "buy signal" for stocks.

ReplyDeleteThose 18 years from 1982-2000 were of course conversely bad for commodites knocking gold to $260. or so.

I wonder though what your thoughts are now because this time things could be somewhat different. The private banker's fiat paradigm has debased our dollar about 98 percent and all world's cuurencies are related to this fiat paradigm so might silver and gold not collapse as they did during the last stock bull market?

The competitive currency devaluation paradigm that is in progress would seem to me to require that eventually the world will need to get back on some sort of at least quasi-gold standard if we are ever to have true honesty and balance in matters of government and trade, etc.

Regardless I will always hold on to some silver and gold as a safety measure.

Regards,

Carl

Hi Derek,

ReplyDeleteJust a note to say thanks for your sharing of knowledge and your thoughtful ability to sound off opinions with a careful eye for fact, and its partner logic, which seems to be scarce in other spots. Logic, that's going to be the commodity that drives the biggest returns when this thing collapses. Anyhow, you put some good facts out there, presenting them in a straighforward way that helps people like me who get good gut senses of where this is headed, and get direction on what areas to continue learning in. I'll be happy to be one of your subscribers.

Thanks for the information and knowledge. May you have many good returns in the market, and in life.

Cathleen