There is literally almost nothing new to report in the way of developments since our last article - The S&P500 is still sitting just a hair above its January high, currently invalidating the terminal pattern that developed to start the initial move down.

This does increase the case for another bullish run in the short-to-mid-term, however the markets have stalled after long time-frame of consistent buying, making higher highs on waning technicals, including the Advance/Decline ratio (which was actually negative for the S&P500 yesterday).

Unfortunately for the shorts, markets like this can plod on for a while - Hope is something that takes a while to fizzle out, and in the meantime it can be an unbearable experience for those waiting for the reversal. Patience is key, and if you don't have that, sit on the sidelines and wait for a clearer signal, or find a few long trades to make in the interim.

A word of caution, however - even though we've scaled back our short position in the meantime, we are not committed to a major long move in the individual markets. That's not to say that some individual stocks and other assets could have excellent performance, as there are great buying opportunities in every market, if one knows where to look.

As such, be careful if you trade to the long side - I'm expecting some sort of small-at-minimum pullback in the markets because they are weak and overbought. But if this consolidation keeps up for some time it usually means the market is building something big and isn't quite ready to pull it out of the oven just yet. Right now it's like watching paint dry, and one needs to be prepared for a move that will surely take either the bulls or bears by surprise.

Economically we are in worse shape than before the major stock indices started declining, with only a fraction of the horribly mailinvested resources from before being liquidated - the rest are hidden on bank balance sheets and undercapitalized, or guaranteed by the government - not to mention that if you factor out the trillions dumped into the economy by the State the GDP numbers are still very negative.

The fact that such a weak recovery has been eked out by such a tsunami of keynesian and monetarist policy indicates that the psychology just isn't taking like it used to - People's attitudes toward money are changing, and such a change takes time - especially after a multi-generational growth of acceptance for burdensome debt.

Stay wary out there because, just like last time, when deflationary forces hit they will snowball quickly and take the maximum number of committed market participants by surprise.

Derek.

Tuesday, March 16, 2010

Subscribe to:

Post Comments (Atom)

Katz has a different perspective, but he bases it on periods where the country was a net creditor:

ReplyDeletehttp://www.gold-eagle.com/editorials_08/katz031510.html

Derek has an interesting point, which coincides more with Baltin:

http://www.gold-eagle.com/editorials_08/baltin031510.html

I have a hard time believing the stock markets are going to boom this summer, with the tightening China is doing.

Maybe we get another run up before summer?

-S

Short Bonds, baby!

ReplyDeleteOk ladies it's poll time!

ReplyDeleteAnyone that has made money through recommendations on this board say "made money".

Anyone who has lost money say "lost money".

Made money on the silver short. Lost money on the FAS short.

ReplyDeleteDefine "money"?

ReplyDeleteDid you mean made dollars? What if you made less dollars than the dollar has lost purchasing power, for example if land in Asia increase by 10% this week and you made 5%? What if you made 3% in dollars but the dollar lost 3% of its purchasing power relative to the Euro?

Truth is no one is making money in the casino. They may get ahead for a while, but like all gamblers, they give it back to the house over time. The interesting thing though is people can not see it, because they think money are digits, but money is what you can actually do with it. Have you tried to anything useful with your money lately? What did you do? Did you create any prosperity for yourself or others, or did you buy more unnecessary junk?

I say the only way to make money, is to create capital. And the only way to create capital, is to create necessary production.

-S

Lost money on shorting the DJIA.

ReplyDeleteThanks bunches, Derek.

Dean

Define money???

ReplyDeleteHe didn't ask that!!

You know what he means by made money!!! profit or loss from decisions made from this board....

Why such a long drawn-out, oh, I'm so smart answer ??? just answer the question? made money or lost money? Seems like everybody's an Einstein on here lately!

Anyone who says that they've made it out of the hole that Derek has put you into with a positive bottom line is probably a baldfaced liar. Or maybe schizophrenic. This guy is dangerous to your wallet. Just to support his own schizophrenias concerning Austrian economics, he uses circular logic and touchy-feely probabilities based solely on misperceived "sentiment" to convince you that things aren't the way that your own eyes and ears tell you they are. RUN!

ReplyDelete-d-

don't you worry you ursa-minded folks, your luck is about to change. i just went long so the market will be crashing shortly.

ReplyDeletethanks! i thought i was going to have to do it.

ReplyDeleteDerek, does more flip-flops then a dolphin in heat. LOL, love the arrows on the same charts one going up and one down. reminds of the three stooges rountine.

ReplyDeleteAgain how can I answer the question if he doesn't define what money is? For example, if the value of an investment declines in dollars by 3%, but the value of the dollar increases by 5% relative to Euro, gold, and things I want to buy, then I made money, while losing dollars. What you don't seem to understand is that by sitting in dollars and doing nothing, you are making or losing money every day (and I tell you are losing).

ReplyDeleteThe more important thing you don't understand, which is why you are blaming Derek for your own addiction, is that you can not generate capital by gambling. And playing in these markets with short-term technical voodoo is gambling. The big banks know exactly where your stops are statistically, because you all move with another herd and they take a statistical sample of brokers they control, which tells them what your stops and decisions will be before you even make them.

I know you won't understand what I have written. And thus you will lose everything by the time this epoch is over in about a decade or so. Remember I warned you.

-S

Strong evidence that silver will outperform within a year, and we are in 2005 correlation

ReplyDeletehttp://goldwetrust.up-with.com/precious-metals-f6/gold-as-an-investment-t60-195.htm#2836

In February Derek said, "We won't see 10700 again for many years".

ReplyDeleteHey Derek, how can you even think of going forward with your website after such a bogus call? Who in their right mind would follow your advice?

@ Anonymous

ReplyDeleteAs I have written dozens and more times in various article, I use probabilities when determining outcomes - no market outcome is ever 100% certain, just more likely than another.

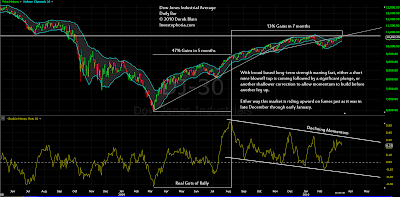

If you follow our tracking of the Dow through December, it looked like the Dow was making a terminal upward pattern that would completely finish off the rally from March '09.

We were expecting a final surge to the 10,650 area which would end the pattern and resume a major downtrend.

The probability of deflationary forces versus inflationary forces is still higher, and thus the probability of a major protracted leg down in the major indices and individual stocks is still a high-probability outcome.

Secondly, as I have also noted before, I shorted the Dow at 10,625, and thus my trade is down 100 points, still below my stop out, and only sitting at a roughly 1% loss. That is the only position in the Dow that I have taken (now scaled down 50% as of Friday at break-even), the only open Dow trade that I have.

Were someone to have made an irrational decision in a highly emotional moment at, say, 10,000 Dow they would be sitting on a significant loss - however I still have only one Dow trade open and one Dow trade published, and that is the trade.

In the meantime, there have been net positive trades such as the gold and silver top in December, Banco Santander, the USD reversal wiping out 5 months of decline in just 8 weeks, as well as a slew of other long trades taken at optimal points in the bear market that yielded profits from 40% up to 500%+.

I cannot be responsible for the irrationality of anyone other than myself, and more importantly, am only responsible for my own trades and their profits/losses.

As I have also mentioned in many of my articles, it is up to each reader to find raw information themselves and draw conclusions - Being human, everything I write is "educated opinion" based on data that I accumulate to see what the big picture says - every such person is a "data filter", and I have specifically referred to this as well on several instances.

Finally, every forecast has a chance of being wrong, and I will admit sometimes I have the tendency to underestimate the duration of existing trends out of a sense of raw disbelief in how long "hope" can hold on for. (See Oil early 2008 as an example - I recommended shorting on a head and shoulders pattern, with a reversal to long if the head was breached. However, oil did trade down from the $140 mark to under $40.00 per bbl, an excellent profit potential in a short time even if someone got into the trade inside the top and bottom by a good margin). But again, this is up to the any individual investor to take what I say and weigh it against their own understanding of the markets - if it makes sense and looks probable, then by all means join in the trade.

If not, or if you or anyone else is pulling the trigger with an elevated heart beat or sense of urgency, I recommend sitting back and taking a second look (and possibly walking away for a few minutes).

Derek.

A higher probability outcome is to IGNORE Derek and buy Citigroup.

ReplyDeleteDerek said then:

ReplyDelete"QUICKLY NOW, YOU'VE GOT THE PICK OF THE LITTER!

Officially, we are short JPM at 39.65."

Derek says now:

If you or anyone else is pulling the trigger with an elevated heart beat or sense of urgency, I recommend sitting back and taking a second look (and possibly walking away for a few minutes).

Great post at 12:10 PM. Thanks!

ReplyDeleteDerek sure does talk out of both sides of his mouth, doesn't he?

As I understand it, Derek is saying he has NOT lost on the trade he called. He took profits on 50% and has a stop loss on the other 50% that has not yet been triggered. Those of you who entered the trade at different prices, or didn't take 50% profits, would not be following Derek's trade. You should be complaining to yourself, not about Derek. I think Derek could do a better job of documenting he entry and exit points, so that people could exactly (without debate or dispute) track his trades and performance.

ReplyDeleteDerek how do you manage to short something without losing value over time, and thus wouldn't your short be farther in the red by now due to the declining value of options over time? Leveraged ETFs lose value over time too, but I assume this is priced into the declining value of puts over time?

Although I have said that technical trading is like gambling, with suitable stops and discipline, I have proven that is most scenarios one can generate gain in the trading currency being employed. However, for example, I noticed when I had such an automated system for trading silver or gold ETFs, the best it could do reliably was about 12 - 19%, which was less than just buy and gold the metal. This is why I say define what money is before you ask whether you made any money. I am pricing my gains relative to average annual fiat price rise in gold.

Derek wrote:

"The probability of deflationary forces versus inflationary forces is still higher, and thus the probability of a major protracted leg down in the major indices and individual stocks is still a high-probability outcome."

I think you are in a trap here on timing. This will be the high probability outcome only when everyone believes deflation has gone away, which will more like 2011/12. My prior post over has a link with a chart that shows why this is the case, based on the yield curve.

The entire 1990s to now has been about feeding the west debt and letting the developing countries work to sustain our debt service with new debt. And this continues. I don't see any reason this reflation can't work too. The limiting factor is when inflation kills the developing world. We are not even close to that yet. We got to that point in early 2008, when food doubled in price over here in a matter of months. And then there was the deflationary take down to clear our the speculators and reflate a new.

When you see everybody has jumped from bonds back into stock market, then it will be time to crash the stock market and bring the retards back into bonds again to sustain the bond bubble.

In short, watch the yield curve.

-S

No, Derek in your postings you make yourself as the greatest trader in the world and that's the fact!!

ReplyDeleteMaybe if you include a table of what your are buy and selling it might help your readers.

Derek can say he DID NOT LOSE any money, but how can you know that for certain? It is so easy to lie about a thing like that.

ReplyDeleteYes, Derek didn't lose any money because he went long when he told us to short.

ReplyDeleteF you, Derek. Bastard.

ReplyDeleteAnon,

ReplyDeleteAdvice FOR FREE, or OPINIONS, are just that..........FREE.

All here are FREE to do with the info /data Derek has given as we see it,interpolate it.

OR NOT DO ANYTHING with it.

So,do not blame Derek if his opinions, and thoughts are taken to heart......

It's up to all of us to do DUE DILLIGENCE.

Name calling is so childish, I find it hard to understand, that and the fact, if you do not like the programs, change the channel.

...a microcosm of our society at large.

ReplyDeleteall our ills and misfortunes are the fault of someone else. it's easier to blame someone who actually has and shares an opinion, than to develop an opinion of our own.

Getting the subject off of bashing Derek... Derek, Shelby, et al; Is today's lower than expected PPI number possibly a hint of deflation to come or something else? Just curious.

ReplyDeleteDave

@Dave

ReplyDeletePPI is a lagging indicator relative to true deflation, and as such it would reflect a level of deflation prior to the actual number being posted. CPI, PPI, etc. are all results that actually follow deflationary periods.

As such, if and when the market does turn down, we should see the PPI % level dipping further into the negatives towards the end of the downward leg.

Derek.

We won't have deflation of developing world until global real interest rates here turn net positive again (as they did in 2007). With roughly 7 times more people than western (deflating leveraged asset) world, and 1/7 the GDP per capita (and growing faster than western GDP is shrinking), I say there is no net deflation on the horizon. TPTB are managing the re-balancing in their favor, which means wild and multi-year cycles between growth and implosion. Again I urge you to read this:

ReplyDeletehttp://www.silverbearcafe.com/private/01.10/thinklikeabanker.html

-S

There have been so many,many,many gurus who have been wrong in the last 7 months. Arch Crawford back in July 2009 was stating after Sept 2009 labour day...it was going to drop big time...wrong. Peasavento wrong, all wrong.

ReplyDelete"Nobody knows what YOU think they do." Now some are right 95% of the time...nobody is 100%.

My call for a drop on Jan 21 was prescient. I stated also that March 16 or after that means 3-4 days would see a drop, a big drop. The move past 1148 changed my mind. All was correct from Jan 4, 2010 except the new high. My up move was 1140/1145 and now new high...but goldman fooled me.

A drop will come March 17 but this drop is not the big one just a minor correction. This drop should take it to 1133/1136 area in the next days and then a move up to 1200-1220 on ES. April 16, May 19 and possibly Aug 10 2010 are important dates.

All has to be in sync, low US index (77/76), gold to $1182/1185, CAD reach 1.02-1.05..CAD/US,ES, YM at highs.

ES should reach 1200-1220 and YM 11000-11,250 by one of these dates. YM is lagging the ES on this last new ES high past 1148.

The key number to watch is 1126.25 on ES and 10364 on YM.

So yes I'm right 85% of the time and I started out with being correct 5% back in 2005. I'll be 95% correct in my predictions by 2011.

If you trade 1 market and spend 5 years following it you will know exactly where it is going 95% of the time. If not then you are an idiot and should not be trading. Never use any indicators...never otherwise you will never get it.

If you are not using any indicators, what the hell are you using to predict these levels and dates?

ReplyDelete